It also includes account type definitions along with examples of the types of transactions or subaccounts each may include. An added bonus of having a properly organized chart of accounts is that it simplifies tax season. The COA tracks your business income and expenses, which you’ll need to report on your income tax return every year.

Determine the structure of your COA

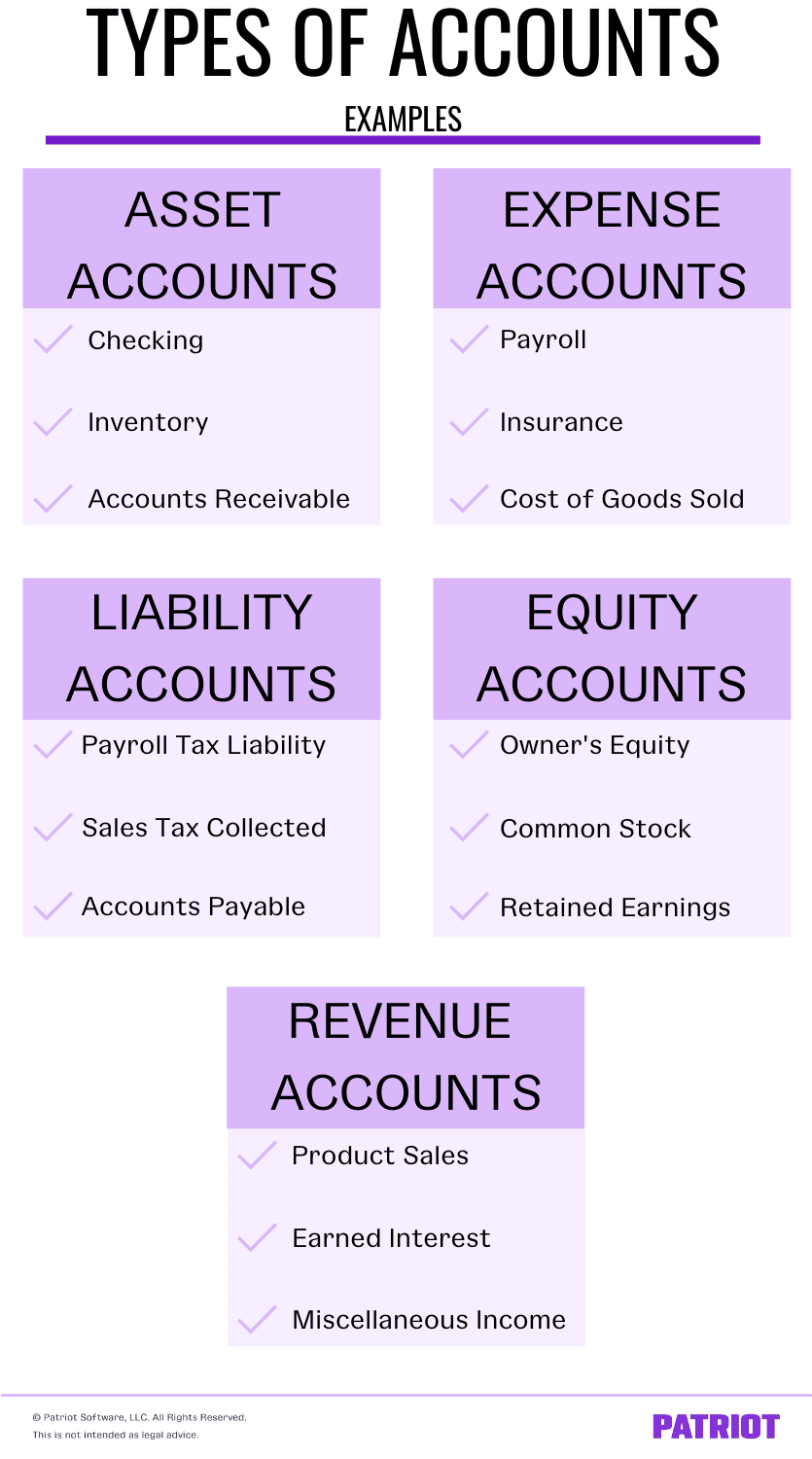

She would then make an adjusting entry to move all of the plaster expenses she already had recorded in the “Lab Supplies” expenses account into the new “Plaster” expenses account. Expense accounts are all of the money and resources you spend in the process of generating revenues, i.e. utilities, wages and rent. QuickBooks Online automatically sets up a chart of accounts for you based on your business, with the option to customise it as needed. The account name is the given title of the business account you’re reporting on, such as bank fees, cash, taxes, etc.

Chart of accounts structure

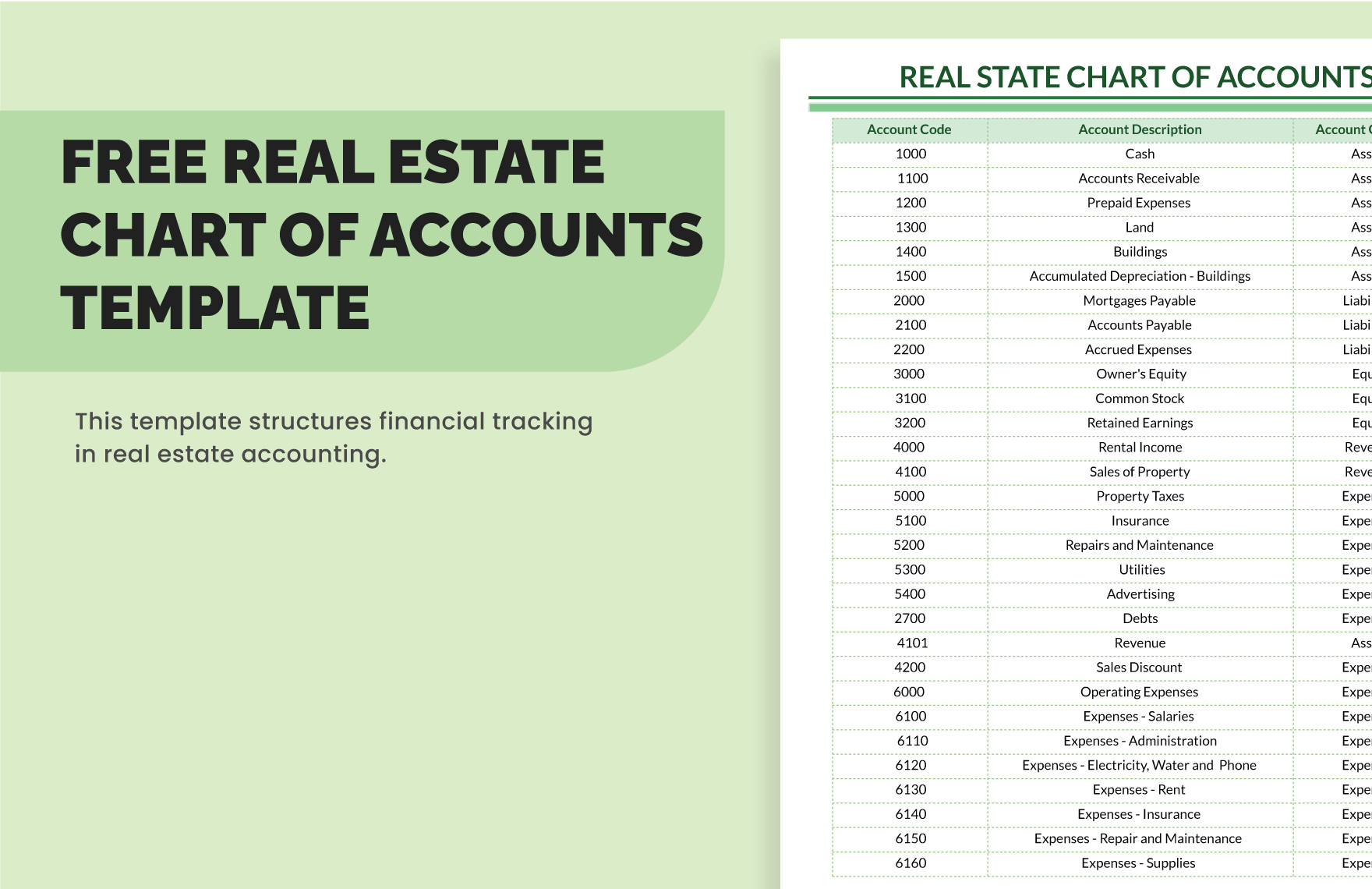

Under each main category, create subcategories to further detail the transactions. The structure of a COA can be customized to fit the specific needs of a business. While smaller businesses may have a simpler, less detailed COA, larger enterprises might require a more complex and detailed structure to accommodate various departments, projects, or locations. This level of detail helps with finer control over financial data and more precise tracking and reporting. This numbering system can vary greatly depending on the size of the business and its specific needs, but it generally follows this logical progression to keep financial activities well-organized.

Sign up for latest finance stories

This is a practical structure for businesses that manufacture or sell products and is a good fit for those looking for added specificity in their chart of accounts structure. Again, using the multiple three- or four-digit sub-account designations will provide more in-depth transaction tracking and overall fiscal transparency. This is followed by the income statement, which includes revenue and expense accounts.

This chart of accounts example includes a variety of common account types and their typical numbering. Actual accounts and numbers can vary depending on each business’s specific needs and structure. Larger businesses may have more detailed accounts, including more specific sub-categories. top excel inventory templates The COA should be tailored to fit the unique accounting needs of each business, capturing all relevant financial activities. A Chart of Accounts is an organized list of the accounts used to categorize and track financial transactions in double-entry bookkeeping.

Marshall is a former Securities & Exchange Commission-registered investment adviser and holds a Bachelor’s degree in finance from Appalachian State University. He frequently speaks at continuing education events.Charles consults with other CPA firms, assisting them with auditing and accounting issues. So, a company can use account coding to generate certain information, such as total cash. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

A chart of accounts gives you great insight into your business’s revenue beyond just telling you how much money you earn. It shows peaks and valleys in your income, how much cash flow is at your disposal, and how long it should last you given your average monthly business expenses. Many organizations structure their COAs so that expense information is separately compiled by department. Thus, the sales department, engineering department, and accounting department all have the same set of expense accounts. Examples of expense accounts include the cost of goods sold (COGS), depreciation expense, utility expense, and wages expense.

Here is an example of a company’s cash accounts being combined for presentation in the financial statements. So, why would you add these additional layers in the chart of account number? Additional account coding can make it easier to create financial statements. For example, in the preceding table, total cash can be determined by adding all accounts preceded with 10-10. More complex entities may have longer account codes to accommodate the reporting needs of the entity. For example, a company might use prefix numbers for specific accounts, such as cash.

- Financial statements consist of the written records that reflect the state of the business, its fiscal activities, and its overall financial performance.

- Each account within the COA is typically assigned a specific number, which helps in identifying and organizing financial information efficiently.

- Each account in the COA is typically set as a unique identifier, often a number, and is organized to reflect the business’s structure and reporting needs.

- This guide offers an in-depth exploration of the chart of accounts, providing definitions, an example, and a downloadable template to enhance your financial organization and reporting.

- In France, liabilities and equity are seen as negative assets and not account types in themselves, just balance accounts.

Not sure where to start or which accounting service fits your needs? Our team is ready to learn about your business and guide you to the right solution. Income tends to be the category that business owners underutilise the most. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

This would include your accounts payable, any taxes you owe the government, or loans you have to repay. But experience has shown that the most common format organizes information by individual account and assigns each account a code and description. What’s important is to use the same format over time for the consistency of period-to-period and year-to-year comparisons. Accounts payable is an account within the general ledger representing a company’s obligation to pay off a short-term debt to its creditors or suppliers. While every COA will differ, there are some basic categories that most organizations will want to include, or at least consider, tailored to the specific nature of your business. Not always employed, thisdesignation is used to controlthe order of accounts asthey appear in the financialstatements and can bebeneficial in making themgenerally simpler to decipherand more actionable.

Your financial statement will provide details of the cash flow (i.e., credit and debit balance). The chart of accounts usually only includes the account number and the account name. The chart of accounts is only a list of the account names and numbers that are currently being used in the accounting system. This list includes every category under which you can classify money spent or earned by your business, from the salaries paid to employees to the revenue from sales. Each category, or “account” in this list, is assigned a unique code to keep things straightforward and consistent.