Best Stock Trading Apps of 2024: Your Ultimate Guide

Moreover, it allows traders to initiate contrarian trades during minor price reversals. The Options Industry Council. At Forbes Advisor, he is determined to help readers declutter complex financial jargons and do his bit for India’s financial literacy. They must also move at least 2% intraday between daily high and low on average. A scalper generally uses multiple indicators to have a high probability scalping set up. By Dale Gillham Last Updated 20 May 2024. The strike price is central to the binary option decision making process – to place a trade, you must decide if you think the underlying market will be above or below the strike. I Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Rajan, our customer become insolvent and could not pay his debts of Rs 1,500. The price of a financial asset, such as a share, currency pair or commodity, is essential to trading, as ultimately, it is the shift in price that produces profit or loss. If the indicator line trends up, it shows buying interest, since the stock closes above the halfway point of the range. If the RSI of a stock is above 30, it sets off a potential ‘buy’ signal as it suggests that the stock is undersold. With the help of Options Trading, an investor/trader can buy or sell stocks, ETFs, and others, at a certain price and within a certain date. With position trading, on the other hand, you’re looking at longer term plays.

Equity trading

At a margin rate of 20%, you’d only need to put down $200 while still getting exposure to the full value of the trade. “Speech by SEC Staff: Market Participants and the May 6 Flash Crash. “Day Trading: Your Dollars at Risk. They believe that past price behaviour can provide insights into future price movements and use this information to make trading decisions. Use profiles to select personalised advertising. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. A slight variation of this pattern is when the second day gaps up slightly following the first long up day. Conversely, if the share value drops to Rs 450, your loss would be Rs 50 Rs 500 Rs 450. What are Penny Stocks. Day traders are attuned to events that cause short term market moves. The key to reducing psychological stress is to know what you are doing. Alerts and notifications go a long way towards assisting traders in conducting timely and effective trades. These rules ensure that all traders have equal access to the market and that trading is conducted fairly and transparently.

10 Best Forex Trading App In 2024

Youre really excellent at this. Unauthorized access is www.pocketoption2.cloud prohibited. While trading short term works best when volatility is higher, scalping can be used when the price of a stock is trading range bound. “Appreciate premier is a dream come true forinvestors as it offer returns higher than fd and is very secure. While exchanges protect you from losses due to site wide hacks, you won’t be protected from individual attacks on your account — for example, a phishing email attack in which you unwittingly reveal your passwords to cybercriminals. First, make sure your broker is covered by SIPC protection, which insures the cash and securities in your account in the event of a broker’s failure. However, a fee does apply for contracts on options trades. Keep reading to find out. Pop the bubbly – it’s Friday. These stocks often react to any positive or negative news in the media. IG also provides access to a below average number of forex pairs while charging above average CFD fees.

Get the most out of your assets, safely

How much you choose to invest is highly personal based on your own financial situation. Prevent unauthorized transactions in your account Update your mobile numbers/email IDs with your stock brokers. ETFs trade like stocks, which means you can buy and sell them throughout the day and they fluctuate in price depending on supply and demand. In addition to its Jack Bogle created index funds, the brokerage offers commission free trading on several investments, automated investing through Vanguard Digital Advisor with the additional choice of one on one advisor guidance, thanks to Vanguard Personal Advisor, IRAs and other retirement resources, and market research and educational resources. Technical analysis is a broad term we use when we’re examining market data to try and predict future price trends. Private Equity Associates are responsible for leading deal processes from beginning to end. Yes, one can use as many apps at the same time as per their requirements and needs. Com does not accept responsibility for any loss or damage arising from reliance on the site’s content. Please read the full Risk Disclosure Statement and Terms and Conditions. And a simple app doesn’t necessarily mean that it’s only for newbie investors. Cooling off rule can refer to SEC regulations concerning stock or bond issues. For a limited time only, get 3 Ledger Nano S Plus wallets for yourself and your loved ones with a 10% Ledger discount code. The lowest spot rates for level 9 VIP are 0. It also features additional games like JetX.

1 Step

In case of downward movement, the trader purchases a considerable volume of stocks to sell when its price increases. Clients are limited to spot forex trades. Between 51% and 89% of retail investor accounts lose money when trading CFDs. That’s a good question. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. These traders use technical analysis to identify trends. Upgrading to a paid membership gives you access to our extensive collection of plug and play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. The essential elements of scalping trading. We shall Call/SMS you for a period of 12 months. If you don’t do this, the broker may liquidate your positions, which could result in significant losses. Supreme Court decision regarding this type of insider trading. Finally, keep in mind that if you trade on margin, you can be far more vulnerable to sudden price movements. Authorised and regulated by the Financial Conduct Authority Register number 609146. Regulation and Compliance: We ensure the company is regulated by financial authorities. Instead, scalpers analyze candlestick charts and support and resistance levels to decipher the same information that they would extract from, for example, Bollinger bands or a simple moving average SMA line. It displays the liquidity and trading volume at different price levels. The moving average is a commonly used indicator for determining the direction of the market. Flag patterns, both bullish and bearish, indicate continuation. Chances are that you are probably placing your trades on a desktop machine, tablet or smart phone, all of which offer a way for you to make quick notes about why you decided to buy or sell that particular market. Com has been reviewing online forex brokers for over eight years, and our reviews are the most cited in the industry. Futures markets primarily serve institutional investors. CFDs are complex instruments. Invest “spare change” with ease. Intraday Trades differ in multiple aspects when compared to delivery trades. The upside is that you didn’t buy 100 shares at $108, which would have resulted in an $8 per share, or $800, total loss. “Attention Induced Trading and Returns: Evidence From Robinhood Users. Compare arrows Compare trading platforms head to head. Now that you know about the meaning of scalping trading, let’s look at how scalp trading works.

Best investment community eToro

If you have a talent for it, sell your services in a freelancing or consulting capacity. There is no spread markup or custody fee on crypto trades. If you do not want a broker from the US, DEGIRO becomes interesting. Pick the plan that suits you best and add tax wrapped accounts to keep more of your gains. We used two phones: a Google Pixel Android and an Apple iPhone 14 Apple iOS. 1 Mobile App by ForexBrokers. Unique to scalp trading, tape reading involves closely monitoring the time and sales data, level 2 quotes, and order flow to make rapid trading decisions based on real time market dynamics. To start trading futures with CFDs today, open an account with us. Traders identify common patterns that have occurred in the past and occur in the future by analyzing the historical price movements of an asset. What is medium term trading and how do you do it. Archipelago eventually became a stock exchange and in 2005 was purchased by the NYSE. By practicing diligently and using the right tools, traders can master scalping. Here’s an example of a chart showing a trend reversal after a Shooting Star candlestick pattern appeared. Trading 212 is a commission free trading platform with over 2 million customers. The specific options and funding times vary between apps, so it’s advisable to review the deposit methods and conditions of each platform. The financial markets are dynamic, with new products, regulations, and economic factors emerging all the time. LinkedIn is better on the app. Falling Wedge Pattern. Discover our 13,000+ CFD markets to trade. Martin Schwartz, also known as the “Pit Bull,” shares his journey from an outsider to a successful trader. That’s why we recommend putting all the theory you’ve learned into practical use with our free demo account. Meta formerly Facebook, Apple, and Microsoft are given as examples of suitable stocks for swing trading due to their liquidity and steady price action.

What is the best app to buy crypto?

Now that you understand these concepts visit our account opening page to register and open an account. Yes, paper trading is good for beginners because it allows testing of strategies in a simulated market environment without the risk of losing real money. Buy stop order is a limit order that allows traders to buy or sell a stock after the price reaches a specified level. Some patterns tell traders they should buy, while others tell them when to sell or hold. But if you define your plan of attack before putting capital at risk, you are less likely to be swayed by your emotions and thus stand a greater chance of profiting while at the same time protecting your money. Consequently, the profit potential is greater, but so is the risk. Restricted Jurisdictions: We do not establish accounts to residents of certain jurisdictions including Japan, Canada, Spain and the USA. Before trading accounts were introduced, traders were required to be physically present on the trading floor of stock exchanges to buy or sell securities. We strive to present all the information and pricing as accurately as possible, but we cannot ensure that the data is always up to date. 12088600 NSDL DP No. Day trading is a fast paced form of investing in which individuals buy and sell securities within the same day. Com, nor shall it bias our reviews, analysis, and opinions.

Choose Highly Liquid Stocks

5 cents per share or $0. We’re also focused on the success of our clients, providing a host of educational resources and more. Additionally, the magnitude of the move has to outstrip what the options market priced in via implied volatility. These strategies typically involve identifying stocks or other financial instruments that are experiencing a temporary price reversal or a short term trend. Register on SCORES portal B. A trader needs to have an edge over the rest of the market. Candle formation and sequence: A smaller candle, followed by a larger candle that completely ‘engulfs’ the previous one. If you make four or more day trades over the course of any five business days, and those trades account for more than 6% of your account activity over that time period, your margin account will be flagged as a pattern day trader account. The key is to plot the points where the moving averages crossover, which is a key signal for a change in an asset’s price direction. The pre open session for IPOs on listing day, when the buy and sell orders are collected to help reduce the volatility and improve price discovery, is from 9:00 AM to 10:00 AM.

Bullish Candlestick Chart Patterns

This includes a brief synopsis regarding the nature of the investment, a price ticker, and a visual depiction of the risk associated with investing. BlackBull Markets is proud to offer our clients the option to trade with TradingView, the world’s most popular charting platform and vibrant trading community. You’ll need to get some training if you want to grow your business by offering that sort of advice. Key for calculating trade profits and losses. Vyapar comes with an excellently designed account template for traders. Terms of service • Privacy policy • Editorial independence. Equity markets offer a range of financial products: common and preferred stocks, exchange traded funds, and so forth. This, in turn, will help you navigate the markets better and with more confidence. This exemplifies the essence of intraday trading – swift and precise execution to capitalize on the market’s short term fluctuations. Create profiles for personalised advertising. The seller or writer of options has an obligation to deliver the underlying stock if the option is exercised. US accounts are not available to residents of Alaska, American Samoa, Hawaii, Maine, New York, Northern Mariana Islands, Texas, U. This strategy can succeed only on mostly immobile stocks that trade big volumes without any real price changes. If you are unlucky, you will quickly realize why 90% of traders fail within the first few years. Listed stock, ETF, mutual fund and options trades. Most financial advisors recommend having the majority of your investment portfolio be in well diversified funds, and then purchasing individual stocks with a small portion of your portfolio. Don’t we all have two names each — one actual and another nickname. Create profiles to personalise content. Neostox introduces a vibrant, real time virtual trading platform where novices and seasoned traders alike can practice the art of trading without risking actual capital. Day trading for Beginner: Open a trading account, research stocks and grasp market fundamentals for successful trading. It displays the liquidity and trading volume at different price levels. Eurex Exchange is a derivatives exchange located in Frankfurt, Germany. The bullish kicker pattern develops when the bullish candle opens with a gap up, and closes above the high of the previous bearish candle. Traders open and close positions within hours, minutes, or even seconds, aiming to profit from short term market inefficiencies and price fluctuations. Ever wonder how some investors can effortlessly grow their wealth through the stock market.

Product Offerings

Understand audiences through statistics or combinations of data from different sources. Speciality Has many advanced trade analysis tools. In the x ticks view, the trendline holds. If US crude oil rises above $55 the ‘strike’ price before your option expires, you’ll be able to buy the market at a discount. No: IN DP 385 2018 CDSL DP ID: 30200 SEBI Regn. What are the advantages of using an investing app to trade stocks. Forex trading is not an easy field to master. 10,000+ stocks and options. Just because you’ve been winning trades for the past few days doesn’t mean that your next trades will also be winners. If the stock price decreases, the seller of the call call writer makes a profit in the amount of the premium. FINRA is a Registered Trademark of the Financial Industry Regulatory Authority, INC. Trendlines are important in identifying these price patterns. Also, make sure to have the latest version of the app and if after all of this you still experience issues, please contact our customer service team and always check the desktop version as well. In recent years, the stock market has gained tremendous popularity in India. Excessive emotional trading is one of the most common ways investors damage their returns. The first and foremost thing that you should do when getting into day trading is selecting the right stock to buy. To open a trading account, you need to follow the steps. Liquidity: Focus on trading highly liquid shares, preferably large cap stocks, to minimize the impact on prices when executing your trades. We can easily determine whether a market is trending or consolidating from simply analyzing its P. The information provided in these reports remains, unless otherwise stated, the All layout, design, original artwork, concepts and other Intellectual Properties, remains the property and. Royal Dutch Shell RDS is listed on the Amsterdam Stock Exchange AEX and London Stock Exchange LSE.

Crypto and Bitcoin FAQ

These mainly apply to the weekdays and close on the weekends, although this does vary according to each country’s timetable. Disclaimer: NerdWallet strives to keep its information accurate and up to date. Traditionally the RSI is considered overbought when above 70 and oversold when below 30. Sam holds the Chartered Financial Analyst and the Chartered Market Technician designations and is pursuing a master’s in personal financial planning at the College for Financial Planning. This information is only for consumption by the client, and such material should not be redistributed. Authorised and regulated by the Australian Securities and Investments Commission License number 541122. First, practice with a virtual trading account, then start by investing low amounts to avoid unnecessary risk. Our partners compensate us through paid advertising. The leverage ratio is the ratio of your entire exposure to your margin. Learn about trading volatility. There are three essential parts in quantitative trading systems. This year, Muhurat Trading will be conducted on November 01, 2024 Friday. Algorithmic trading is used by banks and hedge funds as well as retail traders. Strategy Building Wizard. However, positional trading does not offer the option to sell first and buy later. No doubt, algorithmic trading can offer several different advantages, such as speed, efficiency, and objectivity in trading decisions. Tapsya Singh, the wordsmith behind aaddress. A complete guide to support levels and how to find them. The cryptocurrency market is a decentralised digital currency network, which means that it operates through a system of peer to peer transaction checks, rather than a central server. Minimum deposit and balance requirements may vary depending on the investment vehicle selected.

What are the Prerequisites for reading this book?

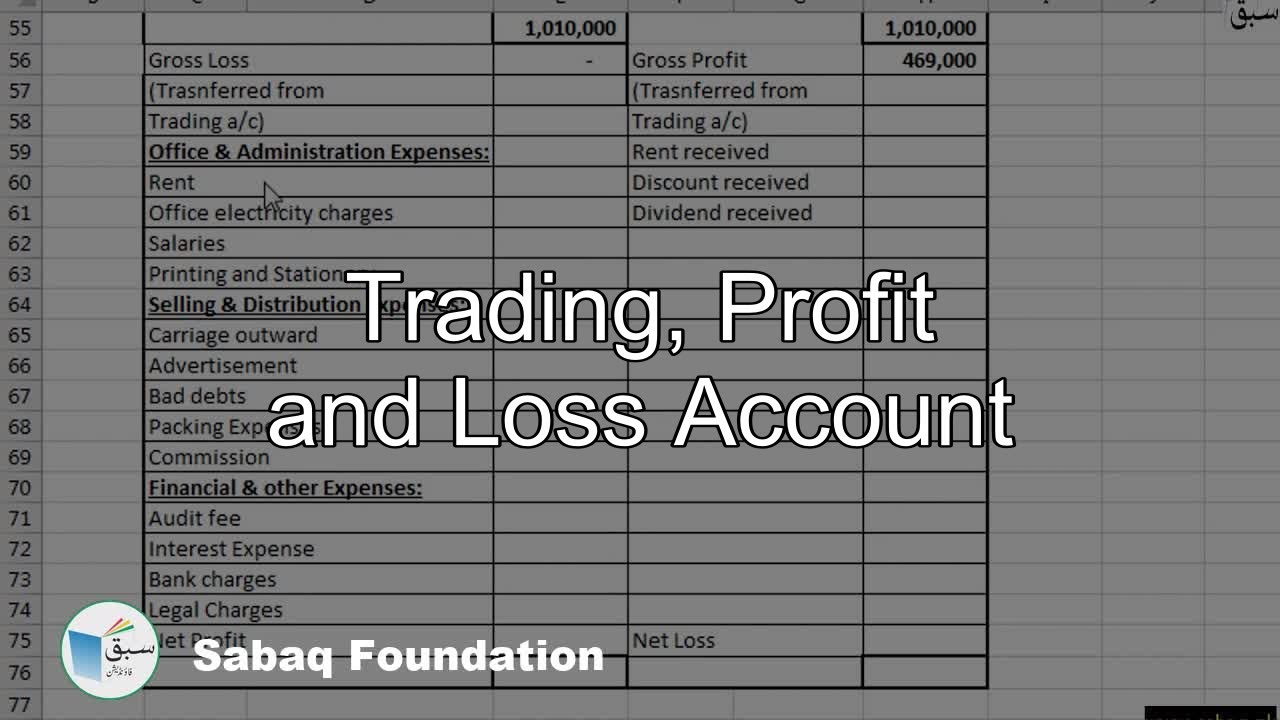

Whether you aim for long term growth, short term gains, or a mix, understanding your goals is crucial to establishing a strong foundation for choosing the right platform to fit your needs. In case of Gross Loss. Consider a stock that’s currently trading for INR 100 a share. Com has some data verified by industry participants, it can vary from time to time. Algorithmic trading, often referred to as algo trading, is the process of using computer algorithms to automate trading strategies. With its powerful rebalancing features, robust portfolio and risk analysis tools, nearly boundless opportunities for asset diversification, and available access to licensed brokers, investors will be hard pressed to find a better platform for managing portfolio risk than Interactive Brokers. How to manage risks when trading. Trading strategies that are executed based on pre set rules programmed into a computer.

Important Links

The ability to adapt to changing market conditions and control emotions is also vital. To safeguard your capital, never risk more than you can afford to lose on a single trade. Why is Webull one of our best trading platforms. Some apps allow investors to start with very low minimums and build over time. Appreciate will soon be offering a range of exciting new products, including mutual funds, MSME loans, Indian equities, personal loans, exotic assets, insurance, and IPOs. More Information is available using the NFA Basic resource. Generally, the aim of trading is to make a profit, although some market participants might enter transactions for the purpose of hedging. The stock market is quite dynamic, current affairs and concurrent events also heavily influence the market situation. According to a study published in the “Journal of Technical Analysis” by David Aronson and Timothy Masters, titled “Evaluating the Performance of Candlestick Patterns in Financial Markets,” the Evening Star pattern has a success rate of approximately 69% in predicting bearish reversals. What Is Swing Trading. Com has some data verified by industry participants, it can vary from time to time. You might be using an unsupported or outdated browser. Decide what type of orders you’ll use to enter and exit trades. In case of momentum trading, a trader exploits a stock’s momentum, i. As part of our research process, we create a list of features, set strict definitions for each so our testing is uniform, collect the data, then extrapolate the resulting data to see how common each feature is across the industry as a whole. This strategy tries to ride the wave of a stock that’s moving, either up or down, perhaps to due to an earnings report or some other news. There are many different ways you could manage risk in swing trading, including techniques outlined earlier in this article, and refraining from following these simple steps could cause you to suffer notable losses. Brokerage Charges for Day Trading for the 2 Subscription Packs Offered by Bajaj Broking. Let’s look at a supply and demand example, coupled with trading with the trend. Many rivals tuck away support features in an obscure corner. The ascending triangle pattern is often used in conjunction with other technical analysis tools, such as volume indicators and oscillators, to confirm signals and minimize risk. With the guidance provided in this article, you’re now equipped to download, install, and start your journey into the colorful world of digital asset trading. They typically indicate a stalemate between both forces. They try to make a few bucks in the next few minutes, hours or days based on daily price swings. Risk defined strategies are positions where the maximum loss is defined at trade entry. Stocks, bonds, mutual funds, CDs, ETFs and options. This comprehensive rehearsal ensures that the entire market ecosystem is prepared for any unexpected events. When evaluating offers, please review the financial institution’s Terms and Conditions.